Overcoming Dental Insurance Obstacles

Drastic electronic overhauls are revolutionizing dental practices and improving the ways offices record and track patients. However, with all this new technology, many dentists still find tracking patient health a primary challenge in maintaining their billing process. Another factor is getting paid.

It has never been easy to collect delinquent bills. The US Consumer Financial Protection Bureau finds that 52% of past due collections come from unpaid medical bills. 43-million people have medical bills they cannot pay, which is one of the challenges dentist offices face when trying to collect. Dental billing can be problematic, but it is not a challenge that can’t be overcome.

Let's take a deeper look at common obstacles clinics are facing in their billing process and what they can do about it.

Inconsistent Copay Collection Hurts Your Bottomline

What are copays? They are down payments for treatment or other services given by a provider. If caregivers don’t get the entire cost of treatment upfront, there may be a struggle to receive the rest of the patient’s portion. Studies found that the chance of receiving remaining treatment costs drops almost 20% as soon as a patient walks out the door.

You can avoid losses by insisting that front desk staff be straightforward with patients when discussing office policy for collecting fees upfront. Remind them they can ask for a credit card to cover copays or other costs when checking patients in before an appointment. If a charge isn't covered by insurance, it may require a down payment in addition to the deductible.

It's in the best interest of the patient and the practice that payments and copays get collected at the time of service. Large bills after completed procedures can be overwhelming and are often more burdensome to pay. For dental practices, collecting copays before rendering services is a surefire way for a business to continue to grow and keep patients in the loop about expected costs.

Some offices choose to write off uncollected copays. However, this is not a viable solution for most dental practices because they can't afford it. Let’s imagine copay situations in a typical office with two doctors and one assistant. An average copay is about $25, so if each doctor sees 12 clients, that's $600 requiring collection daily. If the office is open 200 days a year, you have $120,000 in fees potentially going uncollected.

Know Insurance Coverages Before You Treat

Each patient should have their coverage checked before they arrive for their appointment. Practice administrators should do everything they can to verify patient coverage before services are rendered. This requirement can add to the administrative tasks your team has to take on, but you will find that doing this one thing can prevent billing issues and revenue loss.

If your office doesn't have available staff to handle this process, consider upgrading your current practice management system to one that can run a pre-check on coverage automatically at check-in. With just a few mouse clicks, your team and patients can be aware of what an insurer will or won't cover, making it possible to set up other arrangements so treatment can still be given.

Avoid Skipping Pre-Authorization or Performing Unapproved Procedures

Before carrying out a costly procedure, dentists should set up the patient’s payment arrangements to address any out-of-pocket expenses. Don't be surprised if you find that many patients are unable to cover their portion of treatment costs upfront.

Along the same vein, it's also unsurprising that patients believe their upcoming treatment is covered 100% by insurance. This can lead to quite a shock when learning they are liable for the outstanding balance their insurer declined to pay. Knowing this information ahead of time through pre-authorization checks can allow them time to financially prepare and arrange payment plan options with your office. This simple step ensures patients receive important dental treatment and keeps revenue flowing into your practice.

Another reason you should take time to pre-authorize has to do with billing codes. With the arrival of new procedures and materials, the demand for coding to support them follows suit. Also, yearly coding updates can keep the most conscientious practice managers busy. Often, these changes help clarify or define new areas of coverage and treatment.

How Petaluma Dental Group replaced 10 software vendors with Adit How many software vendors could your practice replace with Adit? Petaluma Dental Group was stuck managing a patchwork of over 10 software tools. None of them integrated; all of...

Download Case StudyTo evaluate how billing will be affected and to note the changes in the codes used most often, each practice should take time to review its protocols. Because of the extensive amount of regular changes, billing managers must be proactive and educate themselves to ensure they are billing procedures correctly.

Additional Insurance Challenges to Consider

Insurance billing tends to cast a long shadow across your financial strategy that can be further complicated by other issues that might arise, such as:

- Time Constraints: A busy practice with insufficient administrative support can create a wealth of potential concerns, especially where manual processes are the leading way billing is completed. Automating the dental office records will benefit everyone involved, and switching to electronic attachments will improve claim settlement times without needing extra staff.

- Detailed Claims Processing Guidelines: Sticking to strict guidelines by government agencies and insurance companies is required. Compliance failure means that your claims will get rejected along with other repercussions. Being able to manage processing guidelines can make a dental office’s billing cycle easier to manage.

-

Lack of Support Solutions: If a claim gets kicked back to the office, it means that claim will more than likely require documentation to support the petition. This doesn't mean you have to print out and mail claim documentation to the payer.

Instead, consider automating this process with a secure electronic claim attachment program. Submit documentation electronically with a tracking number with the payor's information and monitor the claim's progress as it gets processed. Fewer phone calls and less paperwork to track down a claim means you get reimbursed quicker with fewer headaches.

Challenges with insurance billing will always exist, but you can overcome many of them. It's important to remain attentive because there are many factors that are completely out of your hands and impact your bottom line. From economic downturns to increasing premiums, with the right processes in place, you can avoid common administrative and billing shortfalls.

Help Patients Understand How Dental Insurance Works

Most dentists and office managers know there is an inescapable lack of patient understanding when it comes to conventional dental insurance benefits. Patients think that dental insurance works the same as medical insurance in that all procedures, visits, and treatments are covered unless categorized as experimental or elective.

The majority of misunderstanding arises when dental clients need high-cost procedures and find out the proposed treatment isn’t covered by the PPO. This means they'll have additional out-of-pocket costs for all or part of the procedure. It isn’t that the treatment is elective or experimental but that their coverage doesn’t offer a maximum out-of-pocket expense. Dental insurance operates on a maximum benefit plan, and a majority of patients don’t understand this about dental insurance.

How can you, a dental professional, address insurance coverage and affordability issues and still provide a high standard of care? Proper systems and communication are all it comes down to when dealing with clients.

1. Getting Patients to Buy-in

A universal truth is that whether one has insurance or not, they don't give dentistry the same value that you do. Clients may not understand the importance of keeping regular dental appointments and only coming in when there is an emergency.

Others, who may not be able to afford comprehensive coverage, may view dentistry as a high-end luxury and not the necessity it is. It can be terribly frustrating when a patient tells their provider “no” to desperately needed dental treatments, especially when the patient appears to be able to afford some of the finer things in life.

A question that has plagued many dentists is, "Should I recommend a less costly plan of treatment for patients who don’t have insurance?" The answer to this is not necessarily about finances, although it's difficult to not make assumptions about why they don't have coverage. All too often, practices develop discount service plans based on how they perceive patient financial statuses to be versus what they truly are.

Another answer to the above question is to do as most practice management experts advise and offer treatments in phases rather than all or nothing. Remember, a patient may not see the potential benefits of accepting your plan right away, so you need to earn their buy-in.

2. Earning Trust and Loyalty

One of the most critical aspects of addressing affordability issues is keeping the lines of communication open between you and your patients. Two-way communication is important when earning the buy-in of your clients, even though financial discussions can be very uncomfortable.

The fact of the matter is even the most cost-conscious patients will spend money on something if they want it. To overcome financial concerns, it's your responsibility as their dentist to educate them about their treatment plan, why it's important, and the benefits they will enjoy from having it done.

It's also your job to find out their motivations and concerns so there can be a discussion of the “why” of a procedure along with the “what”. Doing this keeps patients cognizant of the positive outcomes of their oral healthcare. Explaining how your services can improve their ability to smile, kiss, chew, and bite makes your pricing less of a surprise and adds value.

No matter how intimidating the conversation may be, you have a duty to go over the full treatment plan, including insurance costs, out-of-pocket expenses, and timeline. Cultivating a relationship of open and honest dialogue will keep patients fully informed and, at the same time, earn their trust. Loyalty to your office comes from patients who trust their dentist and know it would be impossible to receive the same level of service elsewhere.

3. Patients Need Options

It's an unfortunate reality that many patients wrongly believe dentists aren’t happy about treating uninsured patients. It leads to concerns that lack of insurance means paying a pre-negotiated insurance rate for dental care.

For those patients who find themselves with limited insurance benefits or go without any form of insurance, offices should consider different types of payment programs.

Frequently used models include:

-

In-house Savings and/or Membership Programs

These have proven successful in helping dentists make restorative and preventative care feel like it is something patients, both new and existing, can afford. Another benefit of plans like these is your practice takes control of its fees.

Having an in-house dental membership not only ensures that patients feel welcome in your office but gives them a feeling of belonging to a club that offers exclusive members-only savings. More importantly, it allows your office to provide patients with peace of mind and empowers them to provide dental care for the whole family. You can do it all, increase case acceptance for the practice and tighten recall intervals. What a deal!

-

Financial Flexibility

The most critical aspect of affordability is either in-house flexible payment terms, whether offered by the practice or outside patient financing.

Many dentists confuse patients being unable to budget monthly payments as an unwillingness to prioritize their oral healthcare. By giving patients billing options, you create a higher level of financial flexibility so they can make quality oral health a top priority in their life.

Streamline How Your Office Processes Insurance Claims

Dental insurance claims can be complex and confusing to process. However, if you can identify your slowdowns while switching to automation over manual tasks, you can reduce costs and speed up the claims process.

The challenging part is knowing where to start. However, best practices with tech-forward dental practice management software can drastically improve the way insurance claims get processed.

Follow these easy steps to help you streamline the time it takes to process claims in your clinic:

Understand Your Claims Process Workflow

There are a lot of administrative steps involved in patient management issues and processing dental insurance claims.

Mapping out the workflow is one of the first steps to improving any process. By doing this, you can identify all the steps involved and reduce the inefficiencies, bottlenecks, and redundancies creating hurdles. This often generates a boost in your team's productivity, patient satisfaction, and retention rates, and improves your ROI.

The following steps are involved in a typical insurance claims process:

- Claim Submission - You send a dental claim to the insurance company.

- Adjudication - The certified claims processor at the insurance company reviews the claim, compares it to the insurance policy, and validates it.

- Reconciliation - If the benefits cover the claim, the insurance company will pay it out. The claim could be paid in full or made with a partial payment with the balance billed to the patient.

- Validation - The amount applied to the max-out-of-pocket total and deductible.

- Explanation of Benefits (EoB) - The EoB will list how much of the services rendered were covered, what the provider paid, and what remains. This information goes to the patient.

- Billing - The patient will receive a final bill if the insurance doesn’t cover everything in the treatment plan.

- Collection - Finally, the patient pays the claim. Patients should always double-check their EoB to make sure it’s accurate and know that claims can be updated and fixed without any extra charges.

The method you use to map your workflow will depend on how you run your practice and its culture. Some ways to accomplish this are using workflow software, sticky notes, writing in a notebook, or simply writing it down on a whiteboard.

Most important is you clearly lay out each stage of the process as precisely as possible. You will find ways to make improvements once you see the whole process.

Assess Your Dental Claims Process for Inefficiencies

The next step after mapping out your workflows is to look for slowdowns that are hurting your bottomline. Do you see any extra steps in the process? Is it overly complicated or missing something? Do a deep dive into your claims process and always question why and how it works.

Working with your team on this is very important because they're in the trenches and know the ins and outs of this process. Find out what they see as an optimal setup to complete an insurance claim. With this information, you can build an action plan to address discussed inefficiencies and create a more balanced workflow for your entire office.

Collect Patient Information More Efficiently with Electronic Forms

Electronic patient forms allow you to collect detailed data and quickly get the critical information needed for filing dental claims in a safe and secure central location.

You can collect information like a policyholder’s social security number, name, and employment details, among other things, on an electronic form. Then you can submit those details into your system to ensure this information remains secure and organized.

Using electronic documentation is perfect for eliminating bottlenecks and streamlining the overall workload balance in your office. Imagine not having to hunt down traditional paper records somewhere in a wall of cabinets to support a claim. Instead, an integrated practice management system with your EHR automates the entire documentation process.

Below is an in-depth look at how to minimize claim issues using electronic forms:

1. Minimize Data Errors

Claim mistakes and errors are time-consuming to correct and put your practice in unnecessary danger. The best outcome you could hope for when dealing with claim mistakes is that it gets rejected, and your staff has to waste their production time resubmitting it. However, these errors can be costly and leave your office covering the entirety of the denied cost.

And that isn’t the end of it.

Claim mistakes and errors can have more fallout. They can damage relationships, upset patients, harm the workplace culture of your office, and finally, lead to negative reviews that may turn prospective patients away.

The way to avoid claim denials is to ensure you have an up-to-date practice management system or integration to handle day-to-day tasks prone to human error. Implementation of automated tasks can streamline operations and help your team avoid creating additional headaches in an already frustrating process.

PMS platforms like Adit make updating patient records and claims with electronic forms a breeze. Its powerful automated software can input patient data and update their EHR instantly, making it easier to match treatments with the correct coding, minimizing the likelihood of an insurer rejecting the claim.

2. Ensure Your Claim Is Accurate

Want a huge headache? Send a claim to the wrong place! This mistake makes the entire process more frustrating and time-consuming for your office. They don't have time to waste on constantly resubmitting a claim because of mixed-up envelopes or patient information! This is why using dental billing software is a huge benefit to your office and patients when handling claims.

Once the patient data is correct, you can double-check and send the claims out rapidly through your automated system. This keeps you from having to scan, sign, print, and mail claims.

3. Develop Consistent Dental Notation and Charting

Keeping poor clinical notes is one way to make things difficult when you’re trying to get claims paid. To make the filing process smoother, you should get as much data as accurately as you can on each patient.

Utilizing templates for clinical notes, rather than having each dentist do their own thing, will make getting reimbursed much more effortless.

When you create a template, ensure that each dentist takes notes in a consistent and similar manner. This ensures all necessary information is getting into the system each visit.

4. Properly Support Dental Claims with Imaging

If you don't want your claim to get rejected, or only part of it getting paid, remember to send supporting photos, films, and charting information. Not sending in proper documentation almost guarantees a hassle with your patient's insurer when it comes time to get reimbursed.

Be sure to send in all the imaging for implants, crowns, and X-rays for scaling and root planing. Don't forget to include both pre and post-root canal pictures.

If you want your claim to be processed smoothly and quickly, make sure everything is up-to-date, appropriately mounted, and readable.

To Insure or Not

Consumers and providers both struggle with the confusion dental insurance can cause. For many offices, the process of claim follow-up, staff training, red-tape headaches, and reduced reimbursement is greater than the benefits of allowing patients to use insurance. More and more dentists are dropping dental plans, both publicly funded and private, consideration.

Below are four ideas you might consider before deciding to drop insurance acceptance:

1. Increase Staff Productivity with Balanced Workloads

Getting rid of insurance would certainly free up time for your staff as they would no longer need to devote their days to the accounting and billing processes.

No longer accepting an assignment of benefits? You’ll need to determine how patients can pay you upfront and how you can help them submit their own claims to their insurer. While it's true that your dental office would be almost completely cut out of the claims process, patients will still look to your staff for advice or need documentation to send to their insurance company.

Since you already give out payment statements, adding ADA codes for a procedure shouldn’t be difficult. The trade-off is that you’ll have to spend a little more time providing patients with the information they need to file for reimbursement.

2. Transitioning to Self-Pay Only

Be prepared for a pinch when you transition from accepting insurance to only taking direct payments. If your practice has many insured patients, it's most likely that more than a few of them will move to dental offices that will accept their insurance. Most plans allow members to visit out-of-network dentists but require them to pay at the time of service and submit a reimbursement request.

Having patients transition from a copay system is workable but requires excellent communication. It may be difficult for them to handle the initial expense, especially if they are experiencing financial hardship. Still, moving away from insurance can give your office more flexibility in payment options and discount plans to keep your services affordable.

3. Slowly Phase Out Insurers

Finesse is the key to success when transitioning away from insurance. If you are a member of more than one PPO, it may be good to slowly phase out your participation. You don’t need to drop all insurers at once, either. You'll be able to forecast how many patients you might lose for each carrier you drop. This can help you prepare ahead and phase out insurance providers over time instead of at once.

4. Create Insurance Support in Your Office

You’ll continue to want to be an advocate for your patients with their insurance companies. Having an in-office expert on insurance can help patients deal with anxiety about dealing directly with their providers. It's beneficial for your practice to ensure that patients have all the information they need to file their claims and receive reimbursements. Knowing the dentist is an ally in this process can give them peace of mind and return for care.

Deciding to move away from accepting insurance is a decision that must be made by evaluating your particular situation closely. Some practices will benefit greatly from this move, but on the other hand, some offices will struggle. Analyzing demographics and considering the long and short-term effects is the only way to move forward with an informed decision.

Adit Billing Helps Dental Patients Access Care

As a dental professional, you always go the extra mile to help your patients receive crucial oral healthcare when they need it most. Your team does everything possible to help them get the most out of their insurance and this dedication is why your office attracts new prospects and keeps current patrons returning.

Tap into additional revenue by creating an insurance billing process that addresses the many challenges your patients face when it comes to finances, coverage limitations, and a general understanding of how their benefits work. This extra effort makes it possible for you to broaden and tap into revenue streams that were previously neglected or caused frustration in your claims process.

Adit's practice management software has a built-in billing tool to assist your team in processing both dental and medical benefits with automated features and intuitive procedure coding. Our team designed this solution to empower your office by supporting productivity and workflows with over 15 digital tools designed specifically for the dental industry, including:

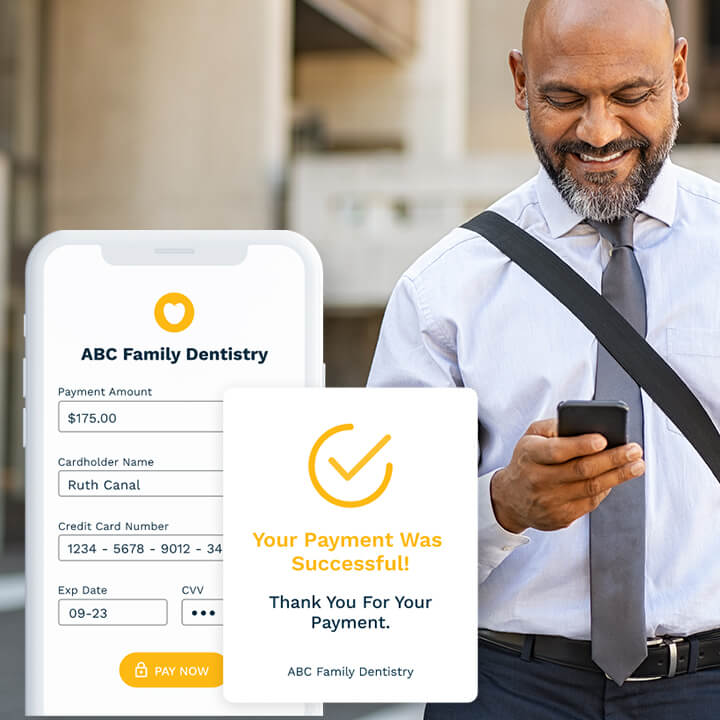

- Adit Pay

- Patient Forms

- Adit Voice

- Online Scheduling

- Appointment Reminders

- Patient Recall

- Call Tracking

- Telemed

- Pozative Reviews

- Internal Chat

- 2-Way Patient Messaging

- Practice Analytics

- And so much more!

Contact our team today to learn more about our advanced billing module Adit Pay, and see our platform in action with a free demo.

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

March 3 Amazon Demo Promo

Terms and Conditions

Last Updated: March 3, 2026Offer ends March 6, 2026, and is limited to prospective customers who sign an annual agreement before March 31, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form