Top Benefits of Dental Billing Software During Tax Season

As tax season approaches, dental practices are gearing up to navigate the complexities of financial management. Amidst the hustle and bustle of gathering receipts, reconciling accounts, and ensuring compliance, dental billing software emerges as a game-changer. This innovative technology not only streamlines the entire process but also offers a myriad of benefits that can significantly ease the burden on dental practitioners and their financial teams during tax season.

Why Tax Season Causes Anxiety for Dentists

Dentists frequently encounter challenges that can make tax season downright frustrating. Disorganized record-keeping, financial inaccuracies, equipment purchases, and more are just a few of the many pitfalls that make filing your dental clinic's taxes a nightmare.

Some common tax season issues for dentists include:

Incomplete or Inaccurate Documentation

Poor documentation is one of the top causes leading to potential delays and errors during tax preparation. Missing receipts, incomplete patient records, and inaccurately recorded expenses create a chaotic environment, making it challenging to compile the necessary financial information accurately.

Navigating Evolving Tax Regulations

Tax regulations are subject to frequent changes, and staying abreast of these updates can seem impossible. The complexities of the tax code, coupled with regulatory updates and amendments, increase the need to ensure financial practices align with the latest guidelines adding to the stress of tax season.

Managing Cash Flow Variability

Dental clinics often experience fluctuations in cash flow, which can complicate financial planning during tax season. The unpredictability of patient appointments, delayed insurance reimbursements, and seasonal variations in business can make it difficult for dentists to project and manage their finances effectively during the tax filing period.

Handling Complex Insurance Reimbursement Processes

Insurance claim processing can be complex, with delays and denials creating frustrating obstacles for dental practices. The lengthy processing times, extensive paperwork, and the constant risk of claim denials create a cumbersome process, impacting both revenue and the overall financial stability of your dental office. Trying to translate all of these factors onto tax forms is even more exasperating.

Integration Challenges with Outdated Software

The use of older practice management software can pose significant integration challenges, especially when navigating tax season. Outdated systems may lack the essential tools and advanced billing features necessary for an efficient tax preparation process. These limitations can lead to manual workarounds, increasing the risk of errors and slowing down the overall billing cycle.

Recognizing and proactively addressing these common tax season issues is key for dental practices to effectively leverage the full potential of their billing software. This tool becomes not only a solution to streamline accounting processes but also helps create a strategy for navigating tax season successfully.

Dental Billing Software: The Essential Companion for a Hassle-Free Tax Season

As the demands of dentistry evolve, modern dental billing software emerges as an indispensable tool for practitioners seeking a hassle-free tax season. From intuitive user interfaces to enhanced features, several key aspects make this software an essential companion for dental professionals during income tax season.

Improved Accuracy and Compliance

Leading-edge dental billing software, like Adit, simplifies tasks, minimizing the chance of human errors that could cause financial issues. Accuracy is crucial during tax season to avoid audits or penalties. With features such as automated coding and real-time validation, this software ensures compliance with ever-changing tax regulations and industry standards. Additionally, it automatically updates patient records and financial information, making accuracy and compliance effortlessly seamless.

Time-Efficient Billing Process

Dental software offers a significant advantage by expediting the billing cycle, a crucial aspect often delayed in traditional manual processes. The inherent time-consuming nature of manual billing can cause substantial delays in revenue collection for any dental office. This delay is often attributed to the manual entry of data, verification processes, and the intricate nature of handling paper-based transactions.

Dr. Martin A. Ruelas’ Dental Practice, dropped 2 other platforms and boosted revenue 20% with Adit Ready to grow your patient base and boost your online reputation? By switching from fragmented systems to Adit’s...

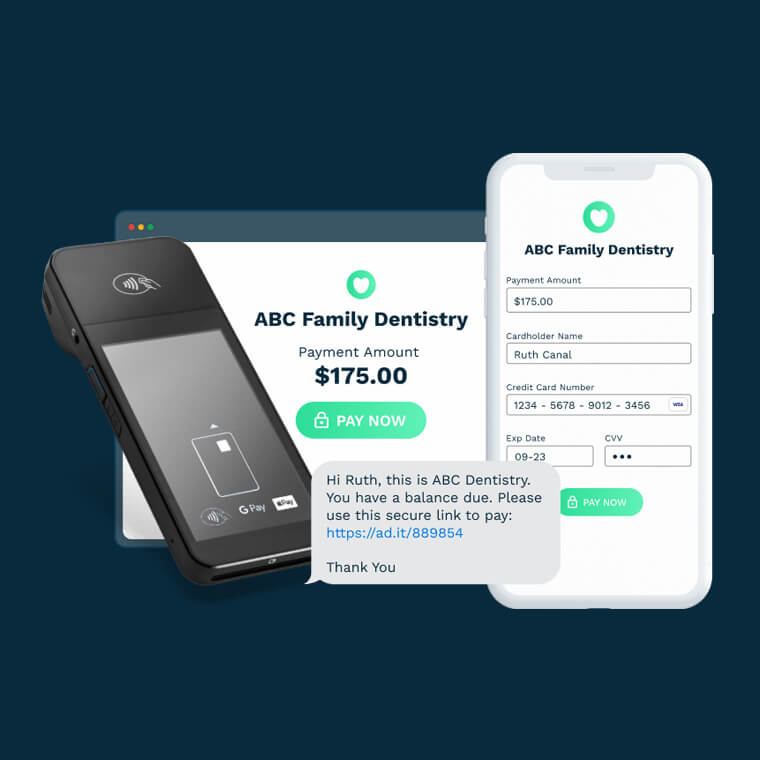

Download Case StudyDental billing software like Adit Pay automates many financial tasks, facilitating swift claims submission, payment tracking, and prompt invoice generation. This newfound efficiency ensures a consistent cash flow and allows dental professionals to redirect their focus from tax-related administrative tasks to patient care.

Streamlined Financial Reporting

Preparing for tax season often involves generating detailed financial reports. Instead of cumbersome manual data compilation, practitioners can generate detailed, customizable reports instantly. Whether it's tracking revenue, monitoring expenses, or analyzing the financial health of the office, these software solutions offer real-time insights, enabling practitioners to make informed decisions and better manage their finances during tax season.

Enhanced Patient Communication

Effective communication with patients is crucial for a successful dental practice. Dental billing software often comes equipped with centralized patient communication features, allowing practitioners to send automated payment reminders, updates on insurance claims, and payment confirmations.

Clear communication not only improves patient satisfaction but also reduces the likelihood of billing disputes, ensuring a smoother tax season without the headache of unresolved financial matters.

Integration with Accounting Systems

Seamless integration with existing accounting systems is a key feature of dental billing software like Adit. This integration eliminates the need for manual data entry and ensures that financial information is accurately reflected in the practice's overall accounting records. As tax season approaches, having all financial data consolidated in one place simplifies the preparation process and minimizes the risk of overlooking critical details the tax man might audit.

Efficient Insurance Claim Processing

Dental billing software often comes equipped with features that streamline the insurance claim process. It automates the submission of claims, verifies eligibility, and tracks the status of claims in real time. This not only accelerates reimbursement but also reduces the likelihood of claim denials. With a smoother insurance claim processing system in place, dental offices can maximize their revenue and minimize financial uncertainties, providing a significant advantage during tax season.

Enhanced Security and Compliance

The sensitive nature of patient information and financial data in dental clinics demands robust security measures. Dental billing software is designed with advanced encryption and compliance protocols, ensuring that all data is securely stored and transmitted. This heightened cybersecurity not only protects patient confidentiality but also safeguards the practice against potential legal and financial ramifications.

Adhering to stringent security standards becomes increasingly crucial during tax season when financial audits and reviews are common.

Customizable Reporting for Tax Planning

Tax season isn't just a bureaucratic obligation; it's a golden opportunity for dental practitioners to strategically plan and optimize their financial landscape. Imagine having the ability to identify specific deduction opportunities, spot potential areas for cost optimization, and maximize your overall tax benefits. For instance, you might uncover deductions related to investments in advanced technology or initiatives that enhance patient care using built-in practice analytics features.

You can efficiently trim liabilities, capitalize on deduction opportunities, and make shrewd financial moves that align with the unique needs of your dental practice.

Paperless Workflow and Eco-Friendly Practices

Dental billing software promotes a paperless workflow, reducing the reliance on physical documentation and paperwork. This contributes to a more eco-friendly and sustainable practice, but more importantly, streamlines document management during tax season. With all financial records digitized and easily accessible in a single centralized location, oral healthcare practitioners can navigate audits and prepare tax documentation more efficiently.

Added Scalability for Growing Dental Offices

As dental offices grow, the ability to scale efficiently becomes crucial. Dental billing software is tailored to seamlessly adapt to the expanding needs of a practice—be it handling more patients, accommodating extra providers, or integrating new services. This scalability not only ensures a smooth ride through tax season without disruptions but also brings valuable tax benefits.

With the flexibility offered by this software, practitioners can focus on business growth instead of getting bogged down by administrative hurdles. In essence, investing in scalable dental billing software is not just about expansion; it's a strategic move to enhance financial agility for a thriving office.

Say Goodbye to Tax Season Stress with Adit Dental Billing Software!

Struggling with the complexities of tax season in your dental practice? Adit Dental Billing Software is the comprehensive solution you've been searching for. Tired of manual errors and compliance headaches? Our software is meticulously designed to eliminate these pain points, ensuring accuracy and reducing the accounting headaches you would normally expect when filing your business returns.

With Adit, you can bid farewell to the stress of delayed billing cycles and communication breakdowns. We understand the unique challenges dentists face during tax season, and that's precisely why Adit provides your team with a toolbox full of cutting-edge management tools to streamline operations, organize important financial data, and boost patient experiences.

- Automated Billing Processes: Streamlines billing cycles, ensuring prompt claims submission.

- Real-time Validation and Compliance: Automates coding for accuracy, ensuring compliance with tax regulations.

- Intuitive Practice Analytics Reporting: Provides on-demand customizable reports for precise financial insights, aiding in tax planning and seamless tax season reporting.

- Streamlined Claim Processing: Accelerates reimbursement, minimizing financial uncertainties during tax season.

- Security in the Cloud: Ensures data security with advanced encryption and compliance protocols, critical during audits and tax season reviews.

- Integration-friendly: Eliminates manual data entry, guaranteeing accurate financial records for straightforward tax season preparations.

- Centralized Communication with Adit Voice: Automates billing reminders, and updates on insurance claims, reducing billing disputes.

- Flexible Scalability: Accommodates practice growth for continuity during tax season and beyond.

- Customizable Electronic Patient Forms and Recordkeeping: Patient Forms reduces reliance on physical documentation, streamlining tax season document management and contributing to eco-friendly practices.

Our innovative practice management platform leaves your office with the time and peace of mind to focus on what truly matters – delivering top-notch patient care. Get your taxes on track with Adit Dental Billing Software and schedule your free demo today.

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoJosh has made a career working with large DSO organizations and leveraging his extensive sales experience to build partnerships with influential doctors and organizations within the dental industry. He travels the US as an expert guest speaker in medical seminars teaching doctors how to streamline their practices with the latest technology.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

February 27 Amazon Demo Promo

Terms and Conditions

Last Updated: February 27, 2026Offer ends March 2, 2026, and is limited to prospective customers who sign an annual agreement before February 28, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form