How to Increase PPO Insurance Reimbursements in 2023

Dental practices have a tough decision when deciding to go in-network. There is the matter of PPO credentialing and spending time negotiating rates to increase the advantage of participation. Ultimately, you want to increase your PPO insurance reimbursements as much as possible, and there are only so many ways you can achieve this goal.

If you feel like your current reimbursement rates have plateaued due to the expected rising costs of dental care in 2023, you may have additional options to help your practice get the most out of being a network provider. Ultimately, it boils down to optimizing your claims submission process and maximizing your collection rate by properly setting up your PPO in your practice management platform.

Ready to start getting more out of your PPO reimbursements? This updated guide has everything you need to know to get started.

The Basics of Setting Up a PPO Fee Schedule

A Preferred Provider Organizations (PPO) is a national insurance company health plan where patients can visit a provider within that specific network for a lower copay or out-of-pocket compared to those not participating.

Setting up these networks involves entering the negotiated fee schedule for your services into your practice management software platform. Most dental practices already have these rates in their databases. However, you should still compare and edit according to the pricing you worked out with the insurer for your practice. This includes code comparisons so your billing department can avoid unnecessary delays and claim denials.

Taking these steps to ensure information regarding fee schedules and coding is accurate in your PMS will enable your team to create estimates of the portions owed by the patient and their insurer.

Setting Up Your PPO Increases Reimbursements from Your National Insurance Company

Curious how a properly set up PPO can improve your insurance reimbursement rates in 2023? Below are the three primary ways that this process can benefit your practice:

Provide Accurate Out-of-Pocket Estimations from Their Health Plans

As mentioned earlier, setting up your PPO correctly in your practice management software database will make it easier to provide your patients with a more precise estimation of their financial responsibility for your services. By ensuring the information you enter is up-to-date and accurately coded, your billing team can prevent frustrating delays or surprise costs.

You can calculate an even more accurate insurance benefit and liability estimation by entering additional plan details, such as:

- Deductibles

- The insurance benefit year

- Policy maximums

- Percentages covered for specific procedures

- Service waiting periods

- Dental benefits

Now, if you hadn't inputted all of this information when setting up the PPO, you would likely end up charging more than what is owed. Having the ability to factor in your contracted rates and conditions with insurers is essential in maximizing your reimbursement rate.

Save on Time Spent Billing Your Services

The downside to processing insurance claims without setting up your PPO in your practice management system is the time lost. Manually calculating the patient's estimated cost of services requires coding and looking up rates. This could be either online or in a large binder of printed rate sheets that are possibly out-of-date.

While they are trying to do this as quickly as possible, your patients are standing there waiting. You could just opt to send them a monthly invoice for your services but doing so could bog down your collection rate.

How Feeley Dental & Associates gained a full day back each week with Adit What happens when a dental office replaces outdated tools with one seamless platform? Feeley Dental & Associates turned to Adit to streamline forms, communication,...

Download Case StudyWorse, if your team makes a mistake when submitting this information manually, you run the risk of nonpayment by both the insurer and the patient because they don't agree on what is owed.

Setting up PPOs in your PMS eliminates all of these complications and produces the required service estimations with just a few quick clicks of a mouse button. Saving time and frustration for all involved. The cost savings on reclaimed productivity is also a significant benefit of this process.

Collect the Right Amount of Revenue at Each Visit

Clinical and administrative efficiency is a top priority for many office owners. You probably already have a list of services you would like to see optimized, including your billing process.

When adding your PPO rates and details to your dental practice management system, you will immediately increase your collection rate. This is due to your only receiving the correct payment amounts for your services. Without this information in your database, you run the risk of overcharging and later refunding the patient. You might also undercharge them and have to explain why they still owe your practice.

Imagine if you just collected a $200 payment from a patient and found out they had only owed your practice $135 for your oral healthcare services. But, you couldn't know this because you didn't have your PPO information set up in your PMS. Instead, you relied on a negotiated rate sheet printed out a few years ago and didn't know about the change in cost. Now you have to process a refund, adding one more task to your hectic day.

What if this situation were reversed and you only collected $135, but the procedure is $200? Your team would have to explain why this mistake was made and request the difference from the patient. This can create a frustrating situation and ruin their experience with your office.

By your practice management software being up-to-date with the latest negotiated rate contract with your PPO, you can provide the most accurate estimated pricing on the day of service.

Get the Most Out of Your PPO Reimbursement Process with Adit Pay

Participating in a PPO network can bring new patients to your dental clinic, but as reimbursement rates continue to drop in 2023 and beyond, you will need to find more ways to maximize your collection rate on claims. At Adit, we have helped clinics like your own achieve higher claim acceptance rates by simplifying the billing process.

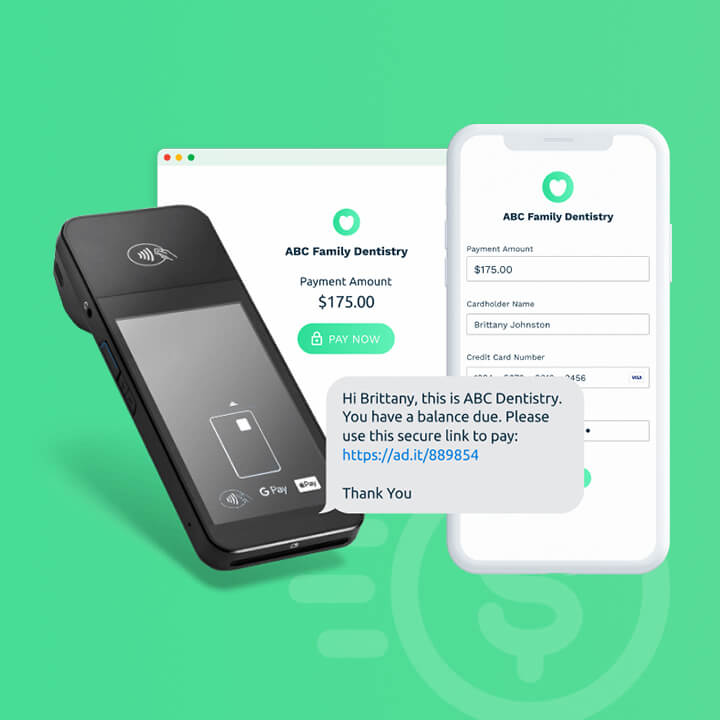

Adit makes the collection process a breeze with automated billing and flexible payment options. Your patients can quickly settle their bills using their preferred mobile or smart device by just clicking a link that takes them to your preferred processor via a secure connection.

Our features seamlessly integrate with most billing software providers, so onboarding your team occurs quickly. Find out more about our billing integration and other tech-forward practice management features that can modernize your dental practice to attract new leads and retain current patients. Request your free demo today!

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

March 4 Amazon Demo Promo

Terms and Conditions

Last Updated: March 4, 2026Offer ends March 7, 2026, and is limited to prospective customers who sign an annual agreement before March 31, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form