Navigating Dental Finances: How Dental Software Enhances Tax Planning and Financial Gains for Dentists

As a dentist, your focus is on providing top-notch patient care, but navigating the intricate world of tax planning and financial management can be overwhelming. In our comprehensive guide, discover how dental software becomes your financial ally, enhancing tax planning and maximizing financial gains for your practice.

Download Ebook

What's Inside?

Unlock the secrets to effective tax planning and financial success with our guide. Dive into the world of all-in-one dental software and explore how it transforms your practice's financial landscape.

Why Tax Planning is Critical for Dentists

Understand the importance of proactive tax planning and unveil the impact of dental software on end-of-year liabilities, deductions, and credits.

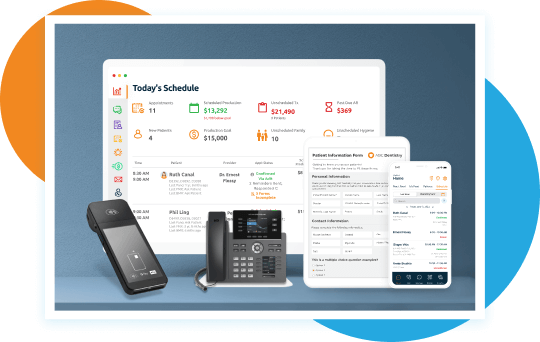

The Role of All-In-One Dental Software

Discover how all-in-one dental software can help your practice streamline financial tracking and reporting while boosting efficiency in billing and revenue cycle management.

Beyond Tax Season: Long-term Financial Gains

How to enhance patient engagement and retention in order to adapt and scale your practice.

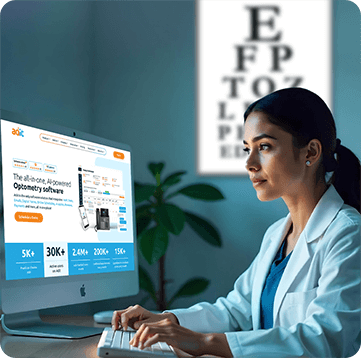

Nailing Tax Season: Let Adit's Software Lead Your Dental Practice

Discover how Adit's all-in-one dental software simplifies tax planning and gain exclusive access to tour the platform.

Benefits

Utilizing dental software for tax planning can help your practice:

Boost Efficiency

Streamline financial processes, ensuring accurate and timely reporting during tax season.

Make Informed Decisions

Gain insights through analytics for strategic financial decisions, aligning with tax goals.

Leverage Automation

Reduce manual invoicing efforts, enhancing billing accuracy and optimizing revenue cycle management.

Foster Long-Term Stability

Support growth, patient engagement, and compliance, contributing to sustained financial success.

Similar content

If you’re practice is still using paper forms on clipboards to check in patients, you could be cutting into more than just your patient’s satisfaction. Discover why patients prefer digital forms and what you can do ditch your clipboards once and for all!

If your dental office is struggling to attract and retain quality patients or has no-shows and cancellations hurting your revenue, it's time to revisit your patient recall approach. Discover the latest strategies and tools dentists are using to get patients back in their chair.

Every decision you make for your dental practice directly affects your patients, team members, and brand. This reality is especially true when choosing the right communication system for your office. With this guide, evaluating your phone systems options won't feel nearly as daunting!

Data, analytics, metrics, KPIs. These are the kind of words we typically associate with big corporations and FBI crime shows, but what do they really mean in the world of dentistry - and more importantly, how can you leverage them to grow your dental practice?

Managing a dental practice has always been a pain, especially when it comes to the patient intake process. Advancements in technology are making it easier than ever to automate and streamline the dental check in process. Discover how you can automate your dental practice’s patient intake process and spend less time on the logistics and more time delighting your patients.

Collecting payments for dental patients at the time of service is an undisputed best practice. However, with insurance hurdles and dental office staff members stretched thin, the average dental office has 18% accounts receivable over 90 days past due. It’s time to explore innovative dental collections strategies that actually work.

As the cost of doing business rises, so does the chatter of the “R” word. Since the Great Recession of 2007, dentistry as an industry largely proved that it was virtually recession-proof and thrived while other industries fell. However, the COVID-19 pandemic revealed that dentistry is not completely immune to a crisis. As hospitals were bursting at the seams, dental practices experienced a 63% drop in patient volume.

So you’re opening a dental practice? Congratulations! You have probably already chosen which intraoral cameras, dental lasers and optical scanners your practice will use. However, have you considered which systems your office and front desk needs to run smoothly? The practice management software and operation tools you invest in now will have a great impact on your growth and success.

While some burnt-out staffers in other industries are “Quiet Quitting”, doing the bare minimum isn’t really an option in an already busy dental office because it just causes more work. Instead, the dental industry is seeing an uptick in staff members outright quitting their jobs, leaving dentists scrambling to boost morale as well as productivity. However, building a positive dental office culture takes more than free donuts and the yearly holiday party.

Everyone knows that running a dental practice is expensive, and with inflation at record highs, dentists are looking for ways to cut costs without having to sacrifice jobs or quality care. We’ve got 4 strategies that can help you lower your monthly overhead without cutting corners.

Dental practice management software can help you create a reliable system to give your patients the experience they desire while streamlining administrative tasks. However, choosing the right dental office management system for your practice’s unique needs can be a huge undertaking. This guide offers the tips and insights you need to pick the right software for the job.

Taking the digital plunge might sound like the modern, eco-friendly thing for dental practices to do, but is going paperless really worth it? This guide explores the benefits and challenges a dental practice may face when making the switch, and outlines the ROI and steps to take to make paperless processes attainable for even the most old-school offices.

In our first Dental Analytics Guide: The Ultimate Guide To Mastering Dental Practice Metrics, we introduced the roadmap to success using dental practice analytics tools. Now, we’ll take a deeper dive into using data to make better decisions that guide your path to success.

So, you’ve outlined everything a patient needs to achieve optimal oral health in the form of a detailed treatment plan, but your patient says “thanks, but, no thanks”. You thought you outlined a clear and necessary course of treatment and presented it in a non-salesy way. What went wrong? Dental treatment plans can overwhelm and discourage patients because they appear confusing, expensive, or too time-consuming. The format in which you present your treatment plan can make all the difference.

Do you want to upsell profitable dental services and procedures without sounding like a pushy salesperson? While every dental practice takes a slightly different approach to treatment plan conversations, when utilized effectively, dental treatment plan software can be a powerful tool to enhance your upselling strategy and your practice profitability.

Dentists have a hard job. They need to make money, but they also want to help patients afford their care. While there are many ways for a dental practice to achieve this, in-house financing is becoming a popular solution that benefits dentists and patients alike. This guide will walk you through the steps and strategies to successfully implement an in-house financing program in your dental practice.

Welcome to the future of dentistry. In this guide, you will discover where to leverage AI in specific areas of your dental practice to enhance patient care, streamline administrative tasks, and more- and also where not to. Learn practical strategies to integrate AI into your operations, stay competitive, and boost your practice’s efficiency and profitability.

In the competitive world of dentistry, building and maintaining a stellar reputation is crucial. Patient reviews have become a powerful tool in shaping how potential patients perceive your practice. This guide offers the insights and strategies needed to harness the power of patient reviews and elevate your practice.

Your dental team is the backbone of your practice, working tirelessly to ensure the well-being and satisfaction of your patients. Recognizing their hard work and dedication is not just a gesture of appreciation but a fundamental aspect of fostering a positive work environment and driving practice success. This guide will show you how!

As a dentist, ensuring dental patients receive the best possible oral healthcare outcomes is a top priority. You know that patient treatment plan acceptance is essential for a successful dental practice, but it can be challenging due to patient concerns and misconceptions about dental procedures. This guide offers effective solutions to improve case presentation and boost patient compliance.

Getting the word out about your dental clinic requires more than having a website with your practice contact information on it. You need a brand identity that shines brighter than the competition and that patients can connect with. Dive into this insightful guide and learn how to boost your clinic's success through effective branding techniques and strategies.

Expanding your dental practice is a sign of growth and enhanced brand recognition, but it also brings the challenge of maintaining the exceptional patient care that earned you your reputation. This ebook will help guide you through this transformative journey with its essential insights into the expansion process and how cutting-edge dental software can streamline your operations and support your continued success.

Did you know that 15% or more of in-network claims are initially denied? Dental claims often face even higher denial rates due to issues like incomplete information or coding errors, leading to significant financial losses for practices and added stress for patients. If your office is struggling to maximize insurance benefits, this ebook offers practical solutions to streamline dental insurance processing.

Ready to help your dental practice stand out and outperform the competition? This ebook shares advanced strategies that differentiate your office from the rest, resulting in enhanced patient engagement and greater brand awareness.

How many hours does your dental team spend on insurance verifications each week? Long wait times and unforeseen eligibility issues can disrupt your practice and affect patient satisfaction. Our ebook explores how advanced dental software can streamline pre-verification, enhancing efficiency, accuracy, and the overall patient experience.

Streamline your dental practice with our ultimate guide to insurance verification. Learn how to automate and improve the process using advanced dental software, reducing claim denials and payment delays while enhancing patient satisfaction. Unlock valuable insights and actionable steps to transform your office's efficiency today!

Learn how practice and reputation management software can enhance your digital presence, helping you attract and retain patients while ensuring your practice thrives in a competitive landscape. Dive in to discover innovative techniques that will transform how patients perceive your practice and set you apart from the competition!

This essential guide reveals how Adit can streamline your operations, enhance patient engagement, and optimize financial management, helping you achieve greater success in today's competitive dental landscape. Packed with actionable insights and practical tips, this ebook is your key to a more efficient and profitable practice. Download your copy now and start transforming your practice!

Whether you're looking to reduce no-shows or improve customer service quality, this guide will provide you with the insights you need. This valuable resource dives into essential features, best practices, and how Adit’s innovative phone system can enhance patient interactions while boosting your team's productivity. Download your free copy now!

This guide shows how integrating online booking saves time, boosts patient retention, and streamlines operations. Download now to improve your practice’s efficiency and keep patients coming back.

Discover how a streamlined patient recall system can improve retention and reduce missed appointments. Download our free guide to learn how customized scripts and automated follow-ups can enhance your practice's success.

Explore how data-driven decision-making can future-proof your DSO, creating a foundation for sustained growth, improved operational agility, and a stronger competitive position in the dental industry.

This comprehensive guide helps optometrists optimize practice management with powerful software features. Learn about scheduling, billing, inventory, patient communication, and tips for selecting the best solution.

Discover how dental billing software can transform your practice by improving accuracy, reducing claim denials, and optimizing financial workflows. Download this comprehensive guide to find the best solution for your needs and take control of your practice’s financial health.

Thank you for downloading!

Check your downloads folder for your guide.