A Dentist’s Guide to Navigating Dental Insurance for Improved Case Acceptance

Navigating dental insurance can be one of the most challenging aspects of running a dental practice. As a dentist, your primary focus is on delivering exceptional care and helping your patients achieve optimal oral health. But often, the complexities of dental insurance can create barriers to treatment acceptance. Patients may hesitate or decline treatment because they feel overwhelmed by confusing insurance jargon, fear high out-of-pocket costs, or misunderstand their coverage.

As frustrating as this can be for dental professionals, there are effective ways to guide your patients through the insurance maze while improving case acceptance. This guide will provide actionable insights on balancing the realities of dental insurance with your commitment to patient care—all while fostering trust and communication.

Understanding the Patient’s Perspective

Dental insurance is not designed to cover all dental care comprehensively. While you and your team may know this, your patients often don’t. Many patients believe that their insurance should fully cover their treatment needs, and when it doesn’t, they may feel disheartened or misled.

Start by empathizing with their perspective. Acknowledge their concerns and frustrations without judgment. Educate them about how dental insurance works and frame it as a helpful tool rather than a comprehensive solution. By doing this, you help set realistic expectations and reduce potential misunderstandings upfront.

Simplify the Insurance Conversation

A lot of words in dental insurance can feel like a foreign language to patients. Terms like “maximum allowable charge,” “UCR (usual, customary, and reasonable fees),” or “frequency limitations” can be daunting. Your role is to simplify this language.

Train your team to explain insurance terms in plain, relatable language. For instance:

- Instead of saying, “Your plan covers 80% of UCR for basic procedures,” try, “Your insurance will help cover part of the cost of this filling, leaving you with about $X to pay.”

- If a patient’s plan has frequency limitations, explain it in terms like, “Your insurance allows two cleanings per year, and you’ve already used those for this period. But here’s why this additional cleaning is important for your health.”

Clarity builds trust, and trust leads to higher case acceptance.

Provide a Financial Roadmap

Break down the treatment plan into manageable steps and explain the costs at each stage. Outline what insurance will likely cover and what the patient will need to pay. Tools like detailed treatment cost estimates, payment plans, or third-party financing options (e.g., CareCredit) can make a significant difference in patients’ willingness to proceed.

For instance, if a patient requires extensive restorative work, they may feel overwhelmed by the total cost. Instead of presenting a single, intimidating number, break it into phases:

- Phase 1: Address urgent issues like decay ($X covered by insurance, $Y out-of-pocket).

- Phase 2: Focus on preventive care and maintenance ($X covered, $Y out-of-pocket).

- Phase 3: Elective or cosmetic treatments (insurance contribution may be minimal, but payment options are available).

By segmenting treatment this way, you make it feel more attainable.

Leverage Pre-Treatment Authorizations

Pre-treatment authorizations (or pre-determinations) can be valuable for giving patients a clearer picture of what their insurance will cover. While these aren’t guarantees, they provide an estimate that helps patients feel more confident in moving forward.

Yes, pre-authorizations can be time-consuming for your team, but the payoff can be worth it. Patients often feel reassured when they see a formal acknowledgment from their insurer. Incorporate this step into your workflow, especially for higher-cost procedures like crowns, root canals, or implants.

How Platinum Care Dental cut 25% manual front desk workload with Adit Lite Got big front desk needs but a small software budget? Adit Lite may be your solution! Platinum Care Dental replaced Opera DDS and World Pay with Adit Lite. With digital forms that auto-upload...

Download Case StudyTrain Your Team as Insurance Navigators

Your front desk and treatment coordinators are often the first point of contact for patients regarding financial discussions. Investing in their training is essential.

Empower your team to:

- Verify insurance benefits thoroughly before appointments.

- Communicate confidently about coverage details and limitations.

- Handle billing inquiries with empathy and patience.

- Proactively discuss financial options, including in-house membership plans or flexible payment solutions.

Patients appreciate when your team is knowledgeable and proactive. This not only improves their experience but also reduces their hesitation about accepting treatment plans.

Be Transparent About Insurance Limitations

Patients need to understand that insurance benefits are typically designed to support preventive care and partially assist with restorative work—not to cover every aspect of dental health. Be upfront about these limitations and explain how they could impact treatment decisions.

For example:

-

“Your insurance covers a standard denture, but if you’re interested in a more comfortable or natural-looking option, there may be an additional cost.”

- “While insurance contributes to the cost of dental implants, it may not cover the entire procedure. Let’s review your options together.”

When you’re honest and transparent, patients feel respected and valued.

Educate Patients on the Value of Oral Health

Sometimes, the resistance to treatment stems from a lack of understanding about its importance. Patients may view dental care as optional, especially when their insurance doesn’t cover a procedure. Your role as a dentist is to bridge that gap by emphasizing the long-term benefits of treatment.

Discuss how delaying care can lead to more complex, painful, and costly issues later. For instance:

- “This small cavity can be treated with a simple filling now, but if we wait, it could progress into something more serious like a root canal or extraction.”

- “Gum disease is manageable at this stage, but if untreated, it can affect your overall health, including your heart and diabetes management.”

When patients see the value of proactive care, they’re more likely to prioritize it.

Offer In-House Membership Plans

For uninsured patients—or those frustrated with limited insurance coverage—offering an in-house membership plan can be a game-changer. These plans typically provide routine preventive care (e.g., cleanings, exams, X-rays) for an annual fee, along with discounts on other treatments.

Membership plans simplify the financial aspect of care and help patients feel they’re getting value without the constraints of traditional insurance. Many practices have found that these plans not only increase case acceptance but also boost patient loyalty.

Follow Up Without Pressure

If a patient hesitates or declines a treatment plan, don’t write them off. Follow up with empathy and an open mind. Often, they need time to process the financial and emotional aspects of care.

A simple follow-up call or email might say:

- “We understand that moving forward with treatment is a big decision. If you have any questions or concerns about the plan or costs, we’re here to help.”

- “Just checking in to see if you’d like us to revisit your treatment options or discuss payment plans. Your oral health is important to us, and we’re happy to support you in any way we can.”

This kind of communication shows patients that you care beyond the transactional aspects of their visit.

Stay Updated on Insurance Trends

Dental insurance policies and trends are constantly evolving. Staying informed about these changes allows you to better guide your patients. For instance, some employers now offer expanded dental benefits as part of wellness initiatives, while others are cutting back. Understanding these shifts helps you anticipate patient concerns and tailor your approach.

Networking with other dental professionals or participating in insurance-focused continuing education can also provide valuable insights.

Navigating dental insurance doesn’t have to be a constant struggle. By simplifying the process, educating your patients, and offering practical solutions, you can improve case acceptance while maintaining a patient-centric approach. When you focus on these principles, you create a practice where patients feel supported and empowered to say “yes” to the care they need.

Transform Your Practice with Adit's Patient-Centered Solutions

Take the next step in transforming your approach to dental insurance. Streamline your processes, educate your patients, and cultivate trust to improve case acceptance. Start building a practice where both you and your patients thrive today!

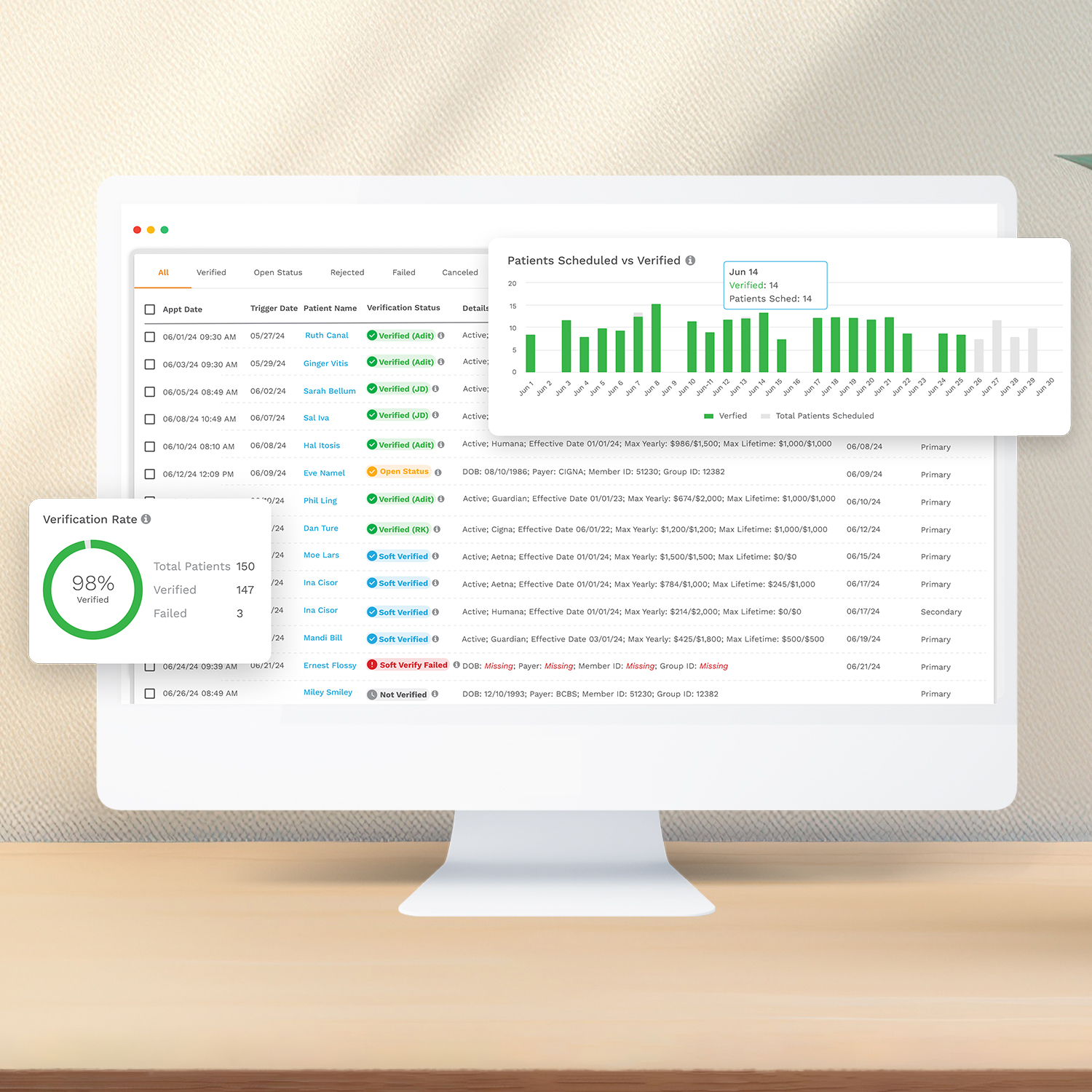

By implementing these strategies and leveraging the right tools, your dental practice can build stronger patient relationships while navigating the complexities of insurance with ease. Adit’s all-in-one dental software is here to help. From streamlining insurance verification to enhancing communication and boosting case acceptance, Adit is designed to support practices like yours in delivering exceptional care.

Take the first step toward a more efficient, patient-focused practice today. Schedule a free demo with Adit and see how we can help you grow your practice while simplifying your workflow!

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

March 3 Amazon Demo Promo

Terms and Conditions

Last Updated: March 3, 2026Offer ends March 6, 2026, and is limited to prospective customers who sign an annual agreement before March 31, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form