How Changes in Dental Insurance Could Affect Your Dental Software in 2024

Dental insurance companies frequently update and modify their policies which impacts dental patients and has a direct effect on the claim submission process for dental practitioners. Changes typically occur at the beginning of each year, making it imperative for dental professionals to stay informed about these upcoming modifications not just for reimbursement, but to ensure their dental software is up-to-date.

To ensure your office stays ahead of these annual insurance changes, we've put together a quick guide covering modifications and how they could impact your current practice management system.

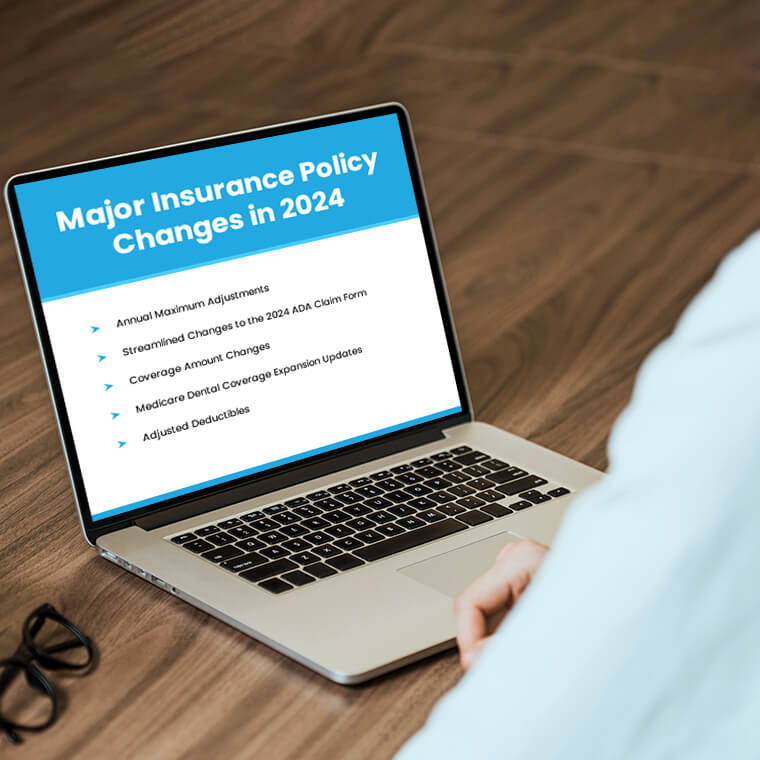

Understanding the Major Insurance Policy Changes in 2024

This year, dental practices need to be particularly vigilant about five significant insurance policy changes that could impact their operations:

Annual Maximum Adjustments

One crucial aspect that tends to be adjusted annually is the annual maximum – the amount an insurance plan will pay for covered dental services within a calendar year. Knowing a patient's annual maximum is vital for treatment planning and financial discussions. Changes to this amount can significantly affect coverage and out-of-pocket expenses for patients.

For instance, if the annual maximum is lowered, practitioners might face claim denials or have to collect more from patients than anticipated. Dental billing software must quickly adjust to these changes, ensuring that practitioners can efficiently manage patient expectations and financial arrangements.

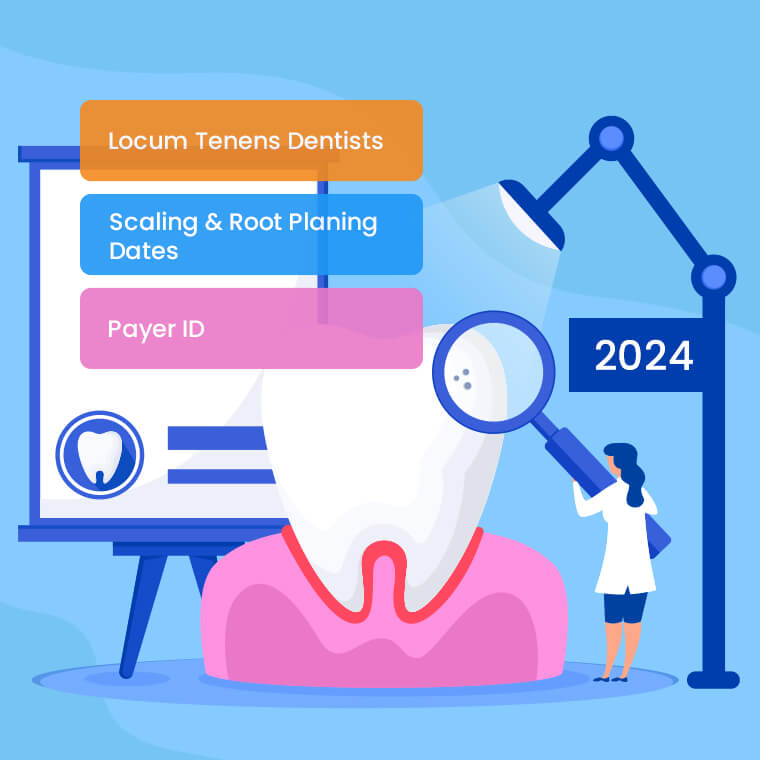

Streamlined Changes to the 2024 ADA Claim Form

The 2024 ADA claim form brings essential enhancements for efficient dental billing.[1] Three key updates aim to expedite processing:

- Locum Tenens Dentists: Box 53a addresses billing challenges for temporary dentists, providing clarity on the role of Locum Tenens practitioners.

- Scaling & Root Planing Dates: Box 39a facilitates easy inclusion of periodontal history on the claim form, ensuring uniform submission for these claims.

- Payer ID: Box 3a introduces a dedicated space for the payer ID, streamlining electronic claim submissions by accurately identifying insurance carriers.

The 2024 ADA claim form is effective starting January 1, 2024, so it's important to adopt this update sooner than later to prevent unnecessary claim rejections. These changes aim to enhance the dental billing process, promoting quicker and more accurate claims processing.

Coverage Amount Changes

Coverage amounts also undergo annual adjustments, impacting eligibility, exclusions, or clauses in insurance coverage. Changes such as the addition of a missing tooth clause can have a profound impact on a patient's out-of-pocket expenses. Dental billing solutions should be equipped to handle alterations in coverage and provide accurate information for billing and treatment timeline adjustments.

AADOM highlights that dental insurance carriers can modify or downgrade procedure codes, shifting them to alternative benefits with reduced coverage.[2] Patients should be informed about this potential policy impact, emphasizing that the insurance company can designate certain procedures as uncovered. In such cases, patients need to comprehend that they will be financially responsible for any disparities in fees arising from these changes.

These alterations not only influence billing but also impact the treatment timeline for the patient. Practitioners may opt to divide the patient's treatment into separate visits to ease the burden of out-of-pocket payments or offer a structured payment plan to distribute the costs over time.

Dental software can play a crucial role in tracking these changes and facilitating effective communication between the dental team and patients about potential financial responsibilities.

Medicare Dental Coverage Expansion Updates

Recent amendments to the 2024 Medicare Physician Fee Schedule (PFS) final rules expand dental coverage in specific scenarios.[3] This has potential ramifications for dental software, influencing billing accuracy, treatment planning, and patient communication.

How Feeley Dental & Associates gained a full day back each week with Adit What happens when a dental office replaces outdated tools with one seamless platform? Feeley Dental & Associates turned to Adit to streamline forms, communication,...

Download Case StudyWhile Medicare typically excludes dental services, exceptions exist, allowing coverage for trauma, tooth removal essential for treating jaw tumors, and inpatient care if hospitalization is medically necessary. The evolving Medicare coverage landscape necessitates dental software adaptability to ensure seamless integration, compliance, and efficiency in managing changing regulations.

Adjusted Deductibles

Deductibles, the amount patients must pay out-of-pocket before insurance coverage begins, are another crucial element subject to annual adjustments. Understanding deductible structures, including individual and family deductibles, is essential for accurate insurance verification and treatment presentations.

Submitting a claim before deductibles have been satisfied can lead to denials, causing inconvenience for both practitioners and patients. Dental software should be updated to handle these deductible changes, providing accurate information for billing processes and ensuring a seamless treatment experience for patients.

Navigating Claim Issues: Proactive Strategies for Dental Practices

Staying ahead of claim issues is essential for the smooth operation of dental practices. By implementing proactive strategies, dental teams can effectively navigate potential challenges arising from insurance policy changes with their practice management software. Here are some key strategies to adopt:

1. Regular Training and Updates

Regular training sessions stand as the cornerstone for ensuring the dental team remains well-informed about the latest insurance policy changes. These sessions extend beyond simply updating policy but enhance the entire claims process, coding alterations, and relevant regulatory modifications.

Creating an environment that encourages open communication and continuous learning about dental insurance coverage within your practice is crucial. This ensures that each of your team members, from the front desk staff to billing specialists, is not only aware of the everyday ins and outs of insurance policies but also equips them to address patient queries effectively. Continuous education becomes key in maintaining a proactive, well-prepared team capable of navigating the complexities of insurance-related challenges.

2. Utilize Advanced Dental Software Features

Using modern dental billing software features is essential when trying to streamline claims processing and adapting to the dynamic nature of insurance policies. Implementing a comprehensive management system is not just about automation; it's about integrating features that verify insurance information in real-time and seamlessly adapt to coding changes.

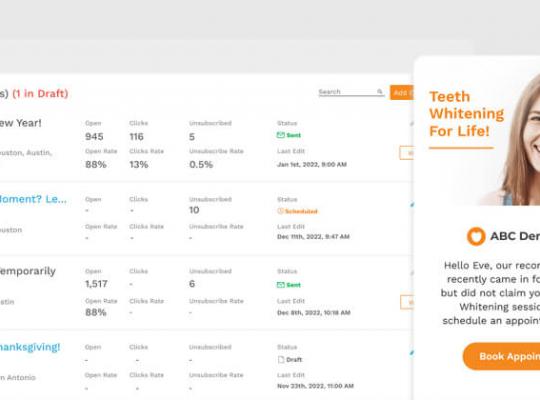

Platforms like Adit integrate artificial intelligence and machine learning within their software to further boost functionality and accuracy. This enables your system to analyze historical claim data, identify patterns, and automatically adjust to coding changes, reducing the risk of claim denials. Regular software updates are essential to keep it aligned with industry standards, ensuring it remains a reliable tool for efficient claims management.

3. Patient Education

Proactive patient education becomes a linchpin in fostering transparency and trust. Developing comprehensive informational materials, such as brochures and online resources, helps patients understand how their insurance coverage impacts their care. These materials should share common insurance terminology, coverage limitations, and potential changes.

Your front desk staff also plays a pivotal role in initiating these discussions with patients during appointments. They should know how to address concerns about coverage changes and clarify any uncertainties patients might have. Integrating educational content into the waiting room experience and the practice's website ensures easy access to relevant information, boosting engagement with your patient base.

4. Real-Time Verification

Implementing a real-time insurance verification process is crucial for maintaining accurate and up-to-date information. Your dental software system should not only check the patient's coverage status but also provide alerts to the staff regarding any recent policy changes.

With readily available electronic eligibility tools synced with your PMS, your team can directly connect with insurance databases minimizing the risk of errors associated with manual data entry. Integration of these features into your clinic's workflow ensures your team is using the most accurate information available before dental services are rendered, minimizing the chances of submitting claims with outdated or incorrect details.

5. Communication Protocols

Establishing clear communication protocols within your dental office is a must to share information about insurance policy changes promptly. This means centralizing information under a single system to ensure that all relevant staff members receive timely updates.

Keeping everyone in the loop is a breeze when using a centralized approach to communicate. Platforms like Adit bring normally siloed channels together, including morning huddles, internal messaging, emails, patient reviews, reminders, call tracking patient recall, and more. This way, your team can avoid mix-ups, build trust with patients, and quickly address any concerns that pop up.

6. Regular Policy Audits and Reviews

In addition to staying informed about policy changes, conducting regular policy audits and reviews is another important step. Designate a team or individual to periodically review your practice's policies to ensure they meet the latest industry standards.

Regular audits will prove invaluable in identifying potential issues before they escalate and also help in optimizing the claims process. This proactive approach can help your policy be aware of policy changes and position itself to adapt when the insurance landscape evolves.

7. Collaboration with Insurance Providers

Establishing collaborative relationships with insurance providers is a proactive strategy that goes beyond negotiating reimbursement rates. Actively engaging with insurance representatives to gain insights into upcoming policy changes, coding updates, and industry trends can help your dental office stay ahead of the curve and maintain a predictable cash flow cycle.

Stay Ahead of 2024 Insurance Changes with Adit Dental Software!

As a dental professional, your commitment to ensuring your patients receive top-notch oral healthcare sets your practice apart. Your team's dedication to maximizing insurance benefits not only attracts new prospects but also fosters loyalty among current patrons.

To boost your practice's revenue further, consider optimizing your insurance billing process to address common challenges faced by patients, such as financial concerns, coverage limitations, and understanding their benefits. This extra effort allows you to tap into previously overlooked revenue streams and eliminates frustration from the claims process.

Our team designed Adit Dental Software as an end-to-end solution that empowers your office throughout the insurance billing process by supporting productivity and workflows with over 15 digital tools designed specifically for the dental industry, including:

- Adit Pay

- Patient Forms

- Adit Voice

- Online Scheduling

- Custom Treatment Planning

- Appointment Reminders

- Patient Recall

- Call Tracking

- Telemed

- Pozative Reviews

- Internal Chat

- 2-Way Patient Messaging

- Practice Analytics

- And so much more!

Reach out to our team today to explore our advanced billing module, Adit Pay, and witness the full potential of our platform. Schedule a free demo today.

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

March 6 Amazon Demo Promo

Terms and Conditions

Last Updated: March 6, 2026Offer ends March 9, 2026, and is limited to prospective customers who sign an annual agreement before March 31, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

when you sign up with Adit!

Sign up by filling out the form