Dental Insurance Verification vs. Insurance Eligibility: Key Differences Explained

Managing insurance processes effectively is vital for the success of any dental practice. Two frequently confused processes, insurance verification, and insurance eligibility, both play pivotal roles in determining patient coverage and claim accuracy. Misunderstanding the difference can result in claim denials, financial losses, and strained patient relationships.

To gain a better understanding of the differences between these two processes and their impact on your office, this article takes you on a deep dive into the world of dental insurance verification. Plus, you'll learn how cloud-based dental billing software can significantly streamline insurance workflows, ultimately improving patient care and your bottom line.

What is Dental Insurance Verification?

Dental insurance verification is the process of confirming the patient's insurance status and verifying the details of their dental coverage before services are rendered. This ensures that the patient’s policy is active and they are eligible for benefits under their plan.

Coverage elements involved in insurance verification:

- Policy Validity: Verifying whether the insurance policy is still active and in good standing with the insurance provider.

- Coverage Details: Confirming which treatments and procedures are covered under the plan.

- Annual Maximums and Deductibles: Checking if the patient has met their deductible and how much coverage remains for the year.

- Waiting Periods: Determining whether a patient is subject to waiting periods for certain procedures.

- Exclusions: Determining which procedures may not be covered under the patient’s plan, such as cosmetic treatments.

Each of these steps ensures your office has complete clarity on what insurance benefits are available to a patient before treatment is scheduled, reducing the risk of billing issues later. However, if your dental billing software fails to properly verify a patient's coverage and eligibility, claims may be rejected or delayed, creating administrative headaches and impacting the treatment experience.

What is Insurance Eligibility?

Insurance eligibility focuses on the patient’s qualification for a specific treatment or service under their plan. Checks can determine whether a particular dental procedure or treatment is not only covered, but factors in specifics such as limits, conditions, or restrictions tied to the proposed treatment.

When determining this information, your dental billing software should help your team:

- Determine Service Coverage: Confirm whether the specific treatment (e.g., crowns, orthodontics, or implants) is included in the patient’s plan.

- Verify Frequency Limitations: Check how often a patient can receive a covered service (e.g., routine cleanings twice per year).

- Identify Procedure-Specific Exclusions: Verify whether certain procedures, such as elective or cosmetic treatments, are excluded from coverage.

- Determine Waiting Periods for Specific Procedures: Some insurance plans impose waiting periods on more expensive treatments like orthodontics or dental implants. Eligibility checks ensure that these are factored in.

- Assess Remaining Benefits: Determine how much dental insurance coverage is left for the year regarding the specific procedure, ensuring patients don’t exceed their yearly limits.

It's important to note that many dentists run into dental insurance challenges when it comes to eligibility because of updated policy rules they aren't familiar with or recent updates made without their knowledge. These issues often result in outdated eligibility information and potential claim denials later.

Key Differences Between Insurance Verification and Eligibility

While both processes deal with patient insurance, they address different aspects of coverage:

| Dental Insurance Verification | Insurance Eligibility |

|---|---|

| Confirms general policy coverage and status | Confirms coverage for a specific treatment |

| Includes policy maximums, deductibles, and waiting periods | Focuses on procedure-specific rules, such as frequency limits or exclusions |

| Ensures the patient is generally covered under their plan | Ensures the treatment in question is eligible for coverage under the patient’s plan |

| Broad in scope—covers the entire insurance policy | Narrow in scope—covers the specific treatment or procedure |

Understanding and differentiating between these two processes ensures accurate dental insurance claims, maximized reimbursements, and improved patient satisfaction.

Why Efficient Insurance Verification Processes Matter

In a fast-paced dental office, the efficiency of your insurance processes can make or break your operational flow and financial health. Dental insurance has a truly complex claim process filled with varied policies, intricate coverage rules, and numerous updates that demand constant attention. Inefficient insurance management leads to more than just administrative headaches—it affects your bottom line, patient relationships, and overall productivity.

Here’s why optimizing both insurance verification and eligibility processes is crucial:

How Feeley Dental & Associates gained a full day back each week with Adit What happens when a dental office replaces outdated tools with one seamless platform? Feeley Dental & Associates turned to Adit to streamline forms, communication,...

Download Case Study1. Minimized Claim Denials and Rejections

One of the most frustrating challenges for any dental practice is dealing with claim denials or rejections from insurance companies. Whether it's due to miscommunication, missing information, or eligibility misunderstandings, incorrect claims lead to:

- Delayed Payments: When a claim is denied, the process of re-submission can take weeks, if not months. This delay disrupts your cash flow, as insurance payments are postponed.

- Increased Administrative Costs: Each denied claim requires additional staff time and resources to investigate, correct, and resubmit. This back-and-forth communication with insurance companies is time-consuming and can easily double the effort needed for each claim.

- Revenue Loss: If claims continue to be denied, your dental office might face substantial financial losses, as unpaid or partially paid treatments accumulate over time. Worse still, patients may be unwilling or unable to cover these unexpected costs, further straining your revenue.

Having an efficient system that automates insurance verification and eligibility checks reduces these errors dramatically. It ensures that every treatment is covered before the patient ever sits in the dental chair, preventing costly mistakes.

2. Improved Patient Satisfaction and Trust

Patients expect their dental visits to be as smooth as possible, both in treatment and financial transparency. Inefficiencies in verifying insurance coverage can lead to frustrating billing issues—such as out-of-pocket costs for services they assumed were covered—leading to frustration, confusion, and dissatisfaction.

When insurance issues arise after treatment, patients often feel blindsided and may start to lose trust in your practice. This can lead to:

- Damaged Relationships: Patients who feel misled by unclear insurance coverage explanations or unexpected bills may choose to leave your dental office for one that better manages their insurance needs.

- Negative Reviews and Referrals: Dissatisfied patients are more likely to share their negative experiences online or with friends and family, which can damage your dental organization’s reputation and deter potential new patients.

Efficient insurance processes, on the other hand, promote patient trust and loyalty. When your practice communicates coverage details clearly and avoids dental billing surprises, patients are more likely to view you as trustworthy and organized. This transparency strengthens relationships and increases patient retention.

3. Enhanced Productivity and Reduced Administrative Burden

The administrative demands of managing insurance processes manually can overwhelm your staff. From spending hours on the phone with insurance companies to double-checking coverage details and filing claims, these tasks consume valuable time and energy that could be better spent elsewhere.

Inefficient insurance workflows lead to:

- Overburdened Staff: When your team is spending the bulk of their time dealing with insurance matters, they have less time to focus on patient care, scheduling, and overall practice management.

- Lower Productivity: Administrative bottlenecks slow your entire office. Simple tasks like verifying a patient’s insurance details before an appointment can drag on, causing delays and reducing the number of patients your team can handle in a day.

- Burnout: Constantly dealing with insurance paperwork and claim rejections can contribute to staff burnout, leading to higher turnover and lower job satisfaction.

By streamlining insurance processes, you can free up dental staff to focus on higher-value tasks, such as patient care, appointment scheduling and follow-ups, and financial growth. As part of an automated dental practice management software, your office can further reduce its manual workload, improve productivity, and create a more efficient treatmeant experience overall.

4. Better Cash Flow Management

Cash flow is the lifeblood of any dental office. Delays in insurance payments can disrupt your financial health, making it harder to cover operational costs, payroll, and supplies. When insurance claims are denied or delayed, the time it takes to resubmit them can significantly impact your revenue cycle, taking weeks or months to receive payments.

Efficient insurance verification and eligibility processes ensure:

- Faster Claims Processing: When your dental practice accurately verifies insurance details up front, the likelihood of claims being approved quickly increases. This accelerates payment turnaround times and keeps cash flowing in steadily.

- Reduced Outstanding Balances: By eliminating unforeseen dental costs and ensuring patients are aware of any out-of-pocket expenses beforehand, your clinic can collect balances sooner rather than chasing overdue payments after treatment.

Ultimately, improved cash flow management gives dental offices the financial stability to grow, invest in new technologies, and provide top-tier care to your patients.

5. Compliance with Regulations

The healthcare industry, including dentistry, is subject to strict regulations when it comes to patient information and dental billing practices. Insurance processes that are not handled properly can expose your clinic to potential compliance risks, such as:

- HIPAA Violations: If insurance details are not verified or handled securely, your dental clinic could inadvertently disclose sensitive patient information, putting your customers at risk and leading to costly HIPAA compliance issues.

- Fraudulent Claims: Submitting incorrect or incomplete claims due to inefficient insurance verification risks accusations of fraudulent dental billing, whether intentional or accidental. Using dental software to automate insurance claim processes ensures that your office remains compliant with industry regulations, protecting you from costly fines, legal challenges, and reputational damage.

An efficient insurance process is no longer a "nice-to-have"—it’s a necessity. Dental practices that prioritize optimizing their insurance verification and eligibility workflows avoid costly claim denials and rejections and build stronger patient relationships, enhance productivity, and improve their overall financial health.

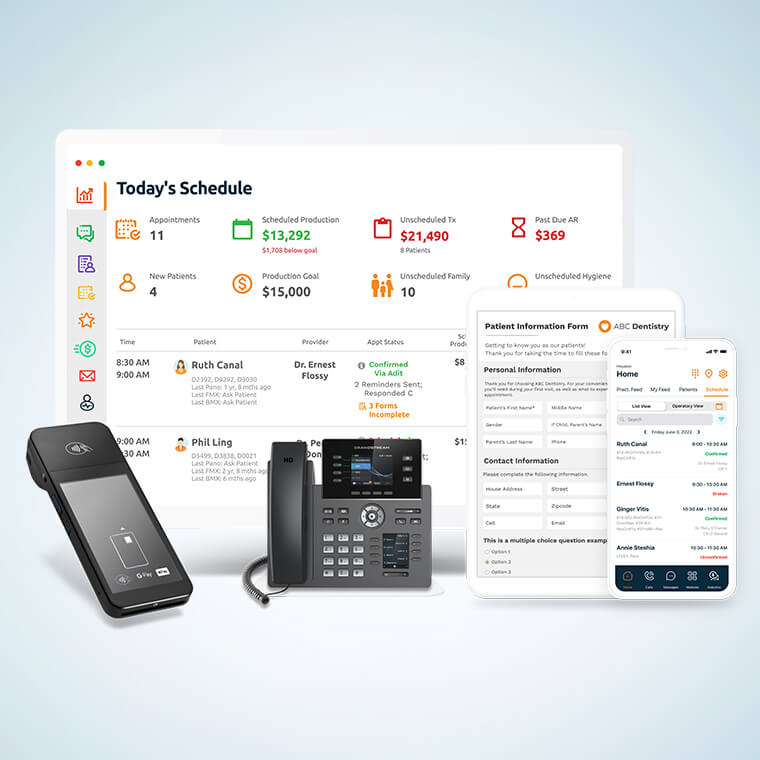

How Adit’s Dental Billing Software Can Help

Adit’s cloud-based dental practice management software offers an all-in-one solution that automates and simplifies both insurance verification and eligibility checks to streamline your billing process. By providing real-time updates and integrating insurance verification into a centralized platform, Adit helps dentists create smoother day-to-day operations, reduce claim denials, and improve patient treatment satisfaction.

1. Automated Insurance Verification and Eligibility Checks

Adit’s dental software automatically verifies insurance coverage, reducing the need for manual phone calls and back-and-forths with insurance providers. This feature pulls real-time coverage data, ensuring that patient insurance policies are verified accurately, including:

- Confirmation of active coverage

- Maximums and deductibles

- Exclusions and waiting periods

Additionally, real-time eligibility checks ensure that the specific treatments planned for each patient are covered, preventing surprises when the bill arrives.

2. Patient Text for Seamless Communication and Payment Flexibility

Adit’s Patient Texting feature provides real-time, direct communication with patients, allowing your practice to send insurance updates, reminders about covered services, and treatment plans instantly via text. This dental software feature helps maintain transparency, keeps patients engaged, and reduces no-shows, as patients are kept informed about their benefits.

3. Automate Reminders and Follow-Ups

Scheduling follow-ups or confirming appointments with patients can be tedious. Our Automated Reminders integration ensures patients don’t miss their appointments or treatments, minimizing no-shows, and keeping your treatment chair full. You can also send follow-up messages, ensuring they remain on track with treatment plans and payment commitments.

4. Streamline Verification with Digital Patient Forms

Manually collecting and inputting patient information can lead to errors. Adit Patient Forms allow patients to share their oral health details ahead of their appointments, including insurance information through online submission. This capability saves time and ensures that all necessary documentation is automatically uploaded and captured, helping your front-office dental team to focus on higher-value tasks.

5. Adit Pay for Automated Dental Billing Solutions

Managing patient payments can be complex, especially when insurance is involved. With Adit Pay, your practice can automate the dental billing process, integrating patient payments with real-time insurance data. This allows your dental office to present clear, accurate bills, reducing confusion and the need for manual payment follow-ups. Adit Pay also streamlines the collection process, ensuring faster, more reliable payments.

6. Adit Voice for Centralized VoIP Communication

Adit Voice is a fully integrated VoIP system that helps your busy dental office handle all communications, including patient scheduling, insurance queries, and reminders, through one centralized platform. This not only increases operational efficiency but also ensures that all patient communication is easily accessible and documented.

7. CareCredit Integration for Patient Financing

When insurance doesn’t cover the full cost of a procedure, patients may hesitate to move forward with necessary treatments. Adit’s exclusive CareCredit integration connects qualifying patients with flexible financing options, making it easier for them to afford the care they need. This feature improves treatment acceptance rates and ensures your practice can offer top-notch care without financial barriers.

Choose Adit to Improve Your Dental Insurance Verification Process

Effective insurance verification and eligibility checks are vital for a smooth-running dental office. Adit offers more than just automation—it provides a customizable end-to-end solution for managing every aspect of patient care. From real-time insurance verification and automated eligibility checks to integrated patient communication and dental billing solutions, we can transform how your billing team handles insurance processes with over sixteen integrated dental practice management software tools.

Schedule a free demo today and see how Adit Dental Software can streamline your insurance workflows to stabilize cash flow and help patients achieve their oral healthcare goals.

more about Adit?

Say goodbye to the hassle of using multiple tools. Adit centralizes your calls, texts, payments, reviews, and scheduling into one powerful dashboard. Simplify your operations and boost patient satisfaction today.

Schedule a DemoAngela is a former English teacher turned marketing content specialist. Over the past 10 years, she’s developed marketing strategies to forge enduring bonds between B2B, B2C and SaaS companies and their clients through holistic education, effective communication, and captivating storytelling that moves audiences to act.

Get a $25 Gift Card when you take a demo

Schedule a DemoGet a $50 Gift Card

when you take a demo

Looks like you're out of bounds!

Hey there! Your current location falls outside Adit's area of operation. If this is unexpected, try disabling your VPN and refresh your page. For further assistance or to book a live demo, connect with us at 832-225-8865.

March 13 Amazon Demo Promo

Terms and Conditions

Last Updated: March 13, 2026Offer ends March 16, 2026, and is limited to prospective customers who sign an annual agreement before March 31, 2026. Gift card will be emailed to the company owner or established representative within 4 weeks of signing the annual agreement. Offer may not be combined with any other offers and is limited to one (1) gift card per office. Offer is not available to current customers or to prospective customers or individuals that have participated in a Adit demo during the prior six (6) months. Recipient is responsible for all taxes and fees associated with receipt and/or use of the gift card as well as reporting the receipt of the gift card as required under applicable federal and state laws. Adit is not responsible for and will not replace the gift card if it is lost or damaged, is not used within any applicable timeframe, or is misused by the recipient. Adit is not responsible for any injury or damage to persons or property which may be caused, directly or indirectly, in whole or in part, from the recipient’s participation in the promotion or receipt or use of the gift card. Recipient agrees to indemnify, defend and hold harmless Adit from and against any and all claims, expenses, and liabilities (including reasonable attorney’s fees) arising out of or relating to a recipient’s participation in the promotion and/or recipient’s acceptance, use or misuse of the gift card. This offer is sponsored by Adit Communications, Inc. and is in no way sponsored, endorsed or administered by, or associated with Amazon.

Thank You!

We appreciate your interest! Adit AI will be calling you in the next few minutes!

Why Adit?

Cut your software bill by up to 60% when you merge everything your dental office needs to run under one roof.

Centralize Communications

- Phones & TeleMed

- Emails & eFax

- Texting & Reminders

- Call Tracking and more!

Streamline Operations

- Patient Forms

- Online Scheduling

- Payments

- Reviews and more!

Boost Production

- Performance Dashboards

- Morning Huddle

- Claims & Collections

- Patient Profiles

- Follow Up Lists

- Year Over Year Metrics

Acquire More Patients

- Digital Marketing

- Website Design

- SEO

- Google Ads

- Facebook Ads

Get ![]() Front Desk free for life when you sign up!

Front Desk free for life when you sign up!

Sign up by filling out the form